Denver, Colorado - LeaseRunner, a leading tenant screening and online leasing rental property software, has updated its suite of online leasing tools with a new mobile-optimized rental application and tenant screening workflow. The new workflow is a one-step process that simplifies the user experience and reduces the time for tenant screening.

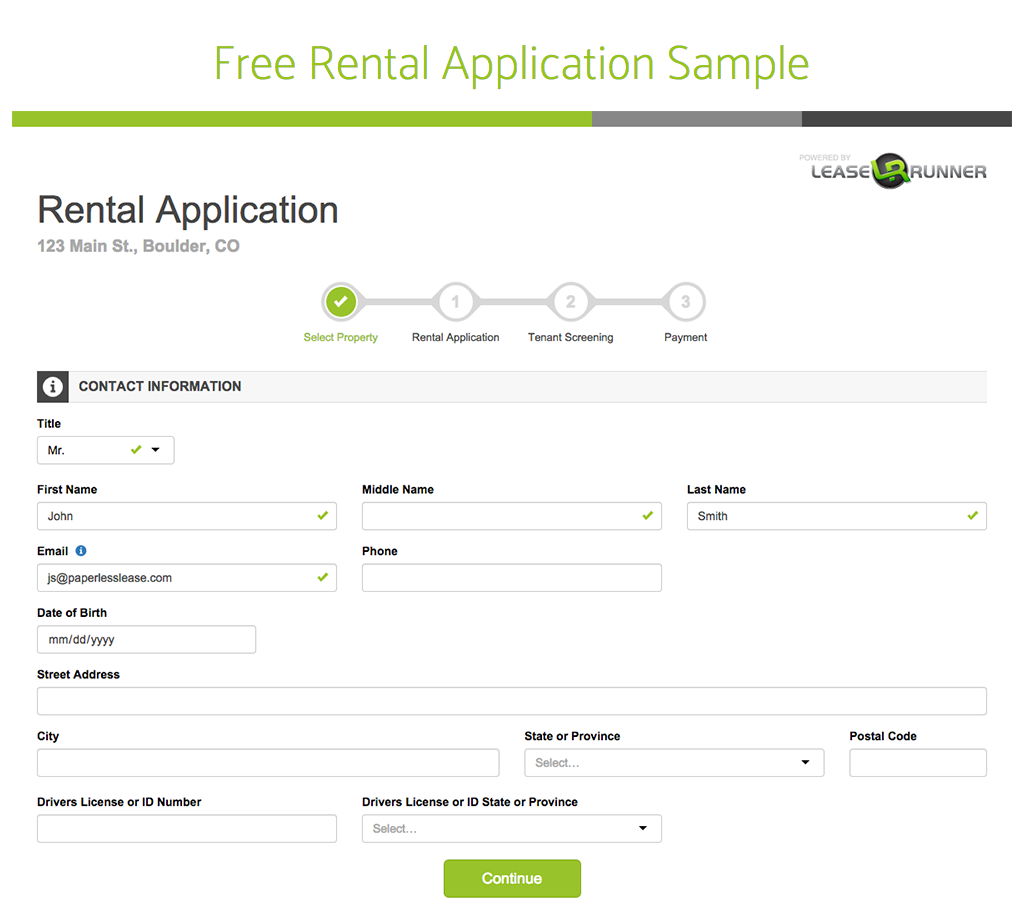

With LeaseRunner’s rental application, a landlord needs only the applicant’s name and email address to start tenant screening. The landlord enters the applicant’s name and email address into LeaseRunner, selects tenant screening services (rental application, credit report, criminal report, and Financial Profile), selects whether the landlord or applicant will pay for the tenant screening cost, and emails out the rental application with tenant screening request to the rental applicant. The applicant completes the request electronically from his or her email at the applicant’s convenience and on any device. All necessary tenant screening authorizations are built in to the rental application, which is compliant with the Federal Credit Reporting Act.

LeaseRunner also rolled out a new tenant screening service called Financial Profile. This report provides the landlord with an analysis of a tenant’s financial health and the ability to pay the monthly rent on time. This report costs less than a credit report and helps a landlord distinguish between two applicants with similar credit scores. “Our customer base asked for a solution to help them choose between multiple applicants with good credit scores and to help screen applicants that have little or no credit history. The Financial Profile does this by analyzing their banking cash flow trends over the last 90 days, and providing verification of income deposits,” said Joe Buczkowski, LeaseRunner’s Founder. The new report graphs the rental applicant’s banking data and provides details and descriptions of deposit activity. The landlord will be able to see if on any given day, the tenant could afford the rent amount while also keeping a balance for other living expenses. Priced at $10, the Financial Profile is less than half the cost of a traditional credit report and takes the applicant only minutes to authorize on their mobile phone.

About LeaseRunner: LeaseRunner is a leading online tenant screening service and rental property management software that allows landlords to manage rental leasing transactions from any web-connected device. LeaseRunner provides tenant screening services to small landlords, property managers, and real estate professionals throughout the United States. LeaseRunner’s services include tenant credit check, tenant background check, eviction check, tenant income verification, online rental ads, online rental applications, lease agreements with e-signature, and online rent collection.