The fast rise of the Islamic finance industry and its eye-watering $3 Trillion asset value has occupied the minds of top executives and politicians. Be it the British government announcing it wants to be the capital of Islamic finance, General Motors issuing Islamic bonds (sukuks), or HSBC offering Islamic banking products, everyone wants a piece of it. However, no one has been as disruptive as silicon valley based startup Fardows.

Today, Muslims are significantly underbanked and excluded from the financial system in the US. This even holds internationally given that 900 million of the 1.8 billion global unbanked population are Muslims.

Islam’s strict ethical standards on financial transactions has meant that most financial services offered in the US are not compliant with the Islamic faith. This often means Muslims have to choose between their faith or finances. For example, loan products that do not involve risk-sharing, such as fixed-interest mortgages, are considered a sin. As such, 420,000 US Muslim families do not own a home, even though they could afford a conventional mortgage. Similarly, Muslims are not allowed to invest in industries that are harmful to society, much like ESG investing. This means that Muslims are not allowed to invest in most stocks and ETFs.

Islamic finance has therefore come up as an ethical alternative to conventional finance. Through its stringent ethical standards, consumers using Islamic financial products can rest assured that their money is being used in a socially responsible manner. This has led to the rapid growth of Islamic finance and has generated strong demand from non-Muslims as well. Muslims around the world are now starting to have access to more financial services. However, corporations in the US have faced significant struggles trying to develop Islamic financial products.

Fardows, a silicon valley based fintech company, was started to change that. Fardows is positioning itself to meet the ever-increasing demand for halal loans, halal banking, and halal investing. While other companies have struggled to successfully launch a Muslim-friendly financial solution in the US, Fardows has excelled at it.

The US Islamic finance market is one that is considerably hard to enter. Not only do financial services firms have to contend with current US financial regulations, but they have to make sure they also comply with Islamic financial regulations. This has posed significant challenges to current financial players in the US market who lack the knowledge on Islamic financial regulation and the nimbleness to apply them.

The few conventional financial firms that have managed to create halal Islamic financial products have then struggled to break into the tight-knit Muslim communities. This has not been the case for Fardows.

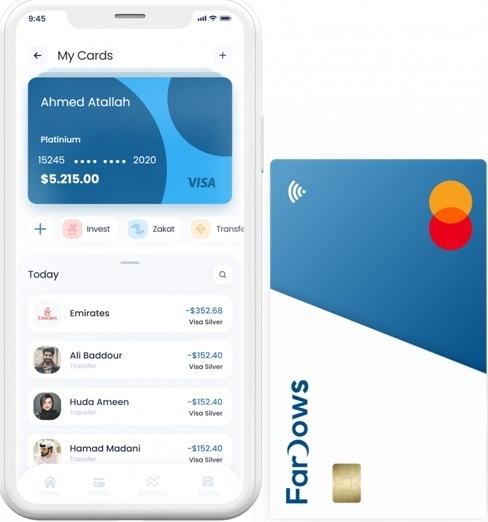

Fardows is developing the first complete fintech solution for Muslim consumers and SMBs. By creating a comprehensive halal platform offering banking, investing and lending services, it is able to support its customers throughout their financial journeys. Its innovative technology allows it to operate at much lower costs than conventional retail banks making it a more scalable business model.

Since launching its waitlist last week, Fardows has gained significant traction and has formed relationships with various financial institutions and local community organizations.

Fardows plans to release its platforms by 2022 and is currently accepting waitlist sign-ups at www.Fardows.com

Media Contact:

Name: Stacey Lambart

Email: [email protected]

Phone: +1 650-687-7073

Organization: Fardows

Website: https://fardows.com/

LinkedIn: https://www.linkedin.com/company/fardows

Location: 450 San Antonio Road, Mountain View, California