EIN-ITIN.COM is a US Based Commercial Service provider specializing in EIN & ITIN applications, as well as US Company formation and federal income tax returns.

EIN-ITIN.COM belongs to Cohen Invesment LLC is a US Company that offers a simple solution to individuals and business owners in need of employee identification and individual taxpayer identification numbers.

Here main services Ein-itin.com provides;

- US Company Formation

- EIN Application

- ITIN Application

- US Federal Income Tax Return

The Internal Revenue Service (IRS) requires all businesses, regardless of size, to have Employer Identification Numbers (EIN) for each employee while all individuals are required to possess a taxpayer identification number (ITIN).

Recently, the Internal Revenue Service has updated and revised its procedures regarding the ITIN application process. The revision revolves around several new elements and updates to existing procedures:

“IRS streamlined the number of documents the agency accepts as proof of identity and foreign status to obtain an ITIN. There are 13 acceptable documents. Each document must be current and contain an expiration date. IRS will accept documents issued within 12 months of the application if no expiration date is normally available. Documents must also show your name and photograph, and support your claim of foreign status. If you will need your original documents for any purpose within 60 days of submitting your ITIN application, you may wish to apply in person at an IRS Taxpayer Assistance Center or CAA,” an excerpt from the IRS official “Revised Application Standards for ITINs” document.

Here you can find the reasons of ITIN Application which most commonly used;

- Non-US Resident who have a US Company.

- Non-US Resident who files US federal income tax return.

- Non-US Resident who claims treaty benefit.

- Non-US Resident who has rental property / house / condo.

- Non-US Resident who purchased rental property with mortgage.

- Non-US Resident who sold the house (if the seller did not obtain the ITIN before)

- Non-US Resident who assumed as US Resident aliens based on days present in the United States filing a US federal income tax return.

- Non-US Residents who has pensions, annuities, rental income, royalties, dividends.

- Non-US Resident who is spouse of US citizen / resident alien.

- Non-US Resident who is a dependent of US citizen / resident alien.

- Non-US Resident who is a dependent / spouse of a nonresident alien holding a US Visa.

- Non-US Resident who is a student, professor, or researcher filing a U.S. federal tax return or claiming an exception

The applicants are required to fill out the Form W-7, attach a federal income tax return to the form, or qualify under an “Exception”. The already-complicated process, hence, became even more convoluted.

The company was founded in 2018 as one of the parts of the Cohen Investment LLC. EIN-ITIN.COM specializes in providing EIN and ITIN applications, as well as federal income tax returns while Cohen Investment LLC is among the IRS-approved Certified Acceptance Agents, providing a portal for taxpayers and businesses to quicker ITIN applications.

One of the biggest benefits EIN-ITIN.COM offers to its customers is email delivery of employee and taxpayer identification numbers. Instead of wasting hours and waiting in long lines to submit their applications, taxpayers and firm owners could skip these processes while still achieving the same results by delegating the application tasks to EIN-ITIN.COM

The EIN-ITIN.COM process is straightforward and fast. Taxpayers only need to order their desired identification number applications; the ordering system will prompt taxpayers to prove their identity via secure, thoroughly encrypted software; then, the program will acquire relevant information, and finally, EIN-ITIN.COM will submit EIN and ITIN application forms to the IRS in the stead of their customers.

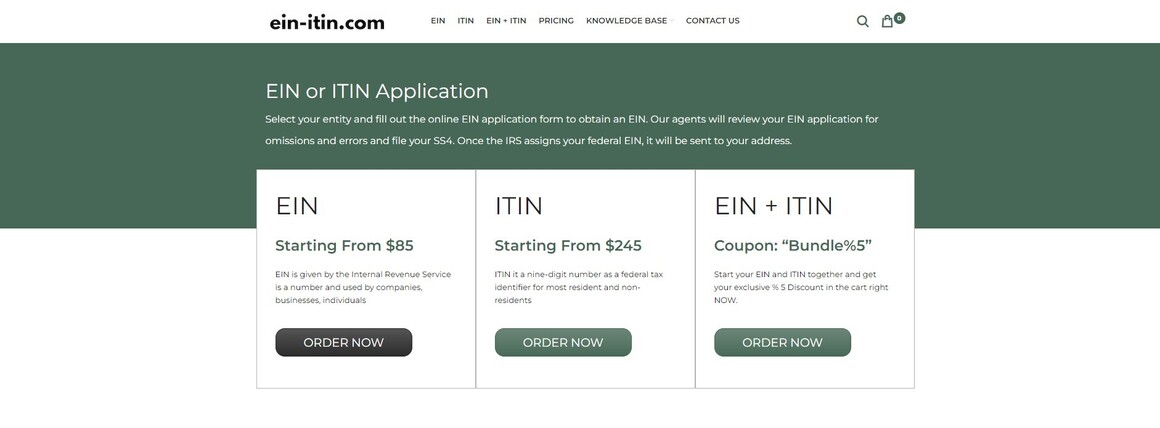

The company offers EIN and ITIN application products, as well as a bundle of both EIN and ITIN applications at a considerably reduced price. EIN-ITIN frequently offers coupon codes, presenting its customers with a discount on EIN + ITIN bundle products.

More information about EIN-ITIN.COM is available on the company’s official website.

Media Contact

Organization: Cohen Investment LLC

Contact Person: Media Relations

Email: [email protected]

Phone: +14702203033

Website: https://ein-itin.com

Address 1: 8 The Green Suite #7591, Dover, DE 19901

City: Dover

State: DE

Country: United States

Information contained on this page is provided by an independent third-party content provider. King Newswire and this Site make no warranties or representations in connection therewith.