Vancouver, British Columbia--(Newsfile Corp. - April 18, 2023) - CARLYLE COMMODITIES CORP. (CSE: CCC) (FSE: BJ4) (OTCQB: CCCFF) ("Carlyle" or the "Company") is pleased to announce that is has received assays from its third and final drill hole from its Phase 1 drill program (the "Phase 1 Drill Program") at its 100% owned Newton Gold-Silver Project (the "Newton Project") near Williams Lake, British Columbia. The Newton Project is a low sulphide epithermal system. The system remains open in multiple directions, particularly to the west, northwest, north and at depth, within a highly prospective (24,000 hectare) land package that is workable all year-round.

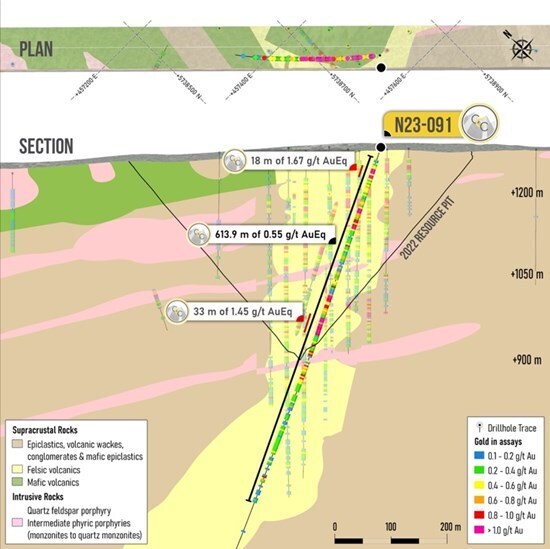

Highlights from drill hole N23-091 include:

- From top of bedrock, intercepted 613.9m (from 18.1 - 632m) of continuous consistent well mineralized bulk tonnage mineralization grading 0.53 g/t Au, 1.93 g/t Ag (0.55 AuEq g/t).

- Higher-grade zone intercepted approximately 18m (from 35-53m) from near surface grading 1.65 g/t Au, 1.83 g/t Ag (1.67 g/t AuEq).

- Higher-grade zone intercepted approximately 33m (from 317-350m) grading 1.41 g/t Au, 3.44 g/t Ag (1.45 g/t AuEq).

- Further confirming the known mineralization extends well below the current inferred mineral resource depth limits, which opens up potential resource expansion.

- Drill holes N23-091 and N23-089 confirm the main mineralized felsic domain remains open at depth, as the bottom of the reported intervals from drill hole N23-091 and drill hole N23-089 are more than 150 meters apart.

- Much of the drill hole intercepted the permeable felsic volcanic unit conducive to gold deposition which hosts most of the inferred mineral resource.

Table 1 - Assay Results N23-091

| Drill Hole | From (m) | To (m) | Int. (m) | Au (g/t) | Ag (g/t) | AuEq (g/t) |

| N23-091 | 18.1 | 668 | 649.9 | 0.50 | 1.87 | 0.53 |

| including | 18.1 | 632 | 613.9 | 0.53 | 1.93 | 0.55 |

| including | 32 | 149 | 117 | 0.80 | 3.06 | 0.84 |

| including | 35 | 53 | 18 | 1.65 | 1.83 | 1.67 |

| and | 110 | 149 | 39 | 0.94 | 6.10 | 1.01 |

| and | 272 | 350 | 78 | 1.07 | 3.18 | 1.11 |

| including | 317 | 350 | 33 | 1.41 | 3.44 | 1.45 |

| Intercepts are downhole core lengths. True widths are not certain. AuEq assumes Au $2,034.95 USD/Oz, Ag $25.10 $USD/Oz and utilizes formula AuEq = (Ag(g/t) * ($Au/$Ag))+Au(g/t | ||||||

Table 2 - Drill Collar UTM Zone 10N

| Hole | Easting | Northing | Elevation | Azimuth | Dip | Length | |

| N23-091 | 457497 | 5738775 | 1275 | 220 | -69 | 764 | |

This third drill hole (drill hole N23-091) completed by Carlyle was collared 110 meters to the north of the first drill hole in the Phase 1 Drill Program (drill hole N23-089) and was drilled to test the continuity of the main mineralized felsic volcanic domain to the north from drill hole N23-089, which historically had not been adequately tested below approximately 500 meters depth. Drill hole N23-091 totalling 764 meters has again confirmed continuity of the well mineralized main felsic volcanic domain, and that the main felsic zone extends and dips to the west, which remains open at depth and in multiple directions. It was important to test this to confirm the Newton Project system is larger than previously understood and this drill hole was successful in doing so by confirming the mineralized felsic domain is more extensive than previously known.

The Phase 1 Drill Program was a key step in confirming the Newton Project hosts numerous opportunities to potentially expand the current inferred mineral resource with highly prospective and untested zones in the immediate area surrounding the known inferred mineral resource.

The Phase 1 Drill Program results, combined with historical data on the property, assist in providing confidence that additional new near surface mineralized zones to the north, west and northwest, as well as at depth may be present. As such, the Company is now finalizing plans for a phase 2 drilling strategy to test some of these potentially higher-grade, near surface zones.

Near surface higher-grade intercepts confirmed in drill hole N23-091, along with historical, underexplored near surface higher-grade intercepts, will be a key focus in phase 2 drilling which will be aimed towards locating additional near surface higher-grade mineralization. The Newton Project contains numerous highly prospective targets which have positive historic results that the Company believes have not been adequately followed up on. Examples of these areas include drill hole 9001 which cut 1.08 g/t Au over 9m (12-21m). This well mineralized zone is on the west end of the inferred mineral resource and remains open in multiple directions. Drill hole 10030 located approximately 400m northwest of the inferred mineral resource intercepted 9m of 1.44 g/t Au from 18-27m depth, and remains open in all directions, and the closest drill hole in proximity to 10030 is drill hole 10027 which is 160m to the southwest. Drill hole 10027 is approximately 350m northwest of the resource and is highlighted by 2.31 g/t Au from 75-78m. For further information on these historical drills results, please see the Company's technical report entitled, "Technical Report on the Updated Mineral Resources Estimate for the Newton Project, British Columbia, Canada" dated June 13, 2022 authored by Michael F. O'Brien, P.Geo., and Douglas Turnbull, P.Geo., which is available under Carlyle's profile on SEDAR as well as Amarc Resources Ltd.'s news releases dated January 19, 2010 and February 10, 2011. Part of the phase 2 drilling will focus on expanding and exploring these underexplored historic higher-grade zones with an aim of expanding the inferred mineral resource to the west, northwest, and north with near surface higher-grade mineralization.

Mr. Jeremy Hanson, Director and VP Exploration, stated: "We are very excited with the results from drill hole N23-091 which extends the known mineralization associated with the main felsic domain more than 150 meters along trend, and remains open. These results certainly support our understanding that the Newton Project contains numerous zones that continue to expand the deposit, and that the Newton Project may contain additional highly prospective underexplored felsic domains, which the Company intends to test in subsequent drill programs."

Mr. Morgan Good, Chief Executive Officer, commented: "After complete review of Carlyle's first drill program at the Newton Project, the Company is thrilled to have confirmed such consistency and continuity of the main felsic volcanic domain to a depth below the known limits of the inferred mineral resource. Having drilled two deep drill holes and intercepting more than half a gram of gold in both gives us confidence in the Newton Project's overall size potential. We have learned there are various higher-grade zones, some near the bottom of the known inferred mineral resource, which is rather interesting, but more notably some close to surface, which leads us to believe there may be a higher-grade zone of interest to target early in a phase 2 drill program this spring."

Figure 1: 75m thick slice, northeast facing cantered at 5738700 N 457400 E including highlights from Drill Hole N23-091. Continuous mineralized intercept of 613.9m (from 18.1 - 632m) of consistent well mineralized bulk tonnage mineralization grading 0.53 g/t Au, 1.93 g/t Ag (0.55 g/t AuEq).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6130/162841_e35505d474860b03_001full.jpg

Figure 2: Plan map of historical drill locations on geology, including Carlyle's Phase 1 Drill Program locations containing drill holes N23-089, N23-090 and N23-091.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6130/162841_e35505d474860b03_002full.jpg

Newton Project Summary

The Newton Project contains a current National Instrument 43-101 ("NI 43-101") Resource Calculation which utilizes optimized pit shell constraints to fulfil the requirement for "reasonable prospects for eventual economic extraction". The inferred mineral resource contains 861,400 oz of Au, and 4,678,000 oz of Ag with an average grade of 0.63 g/t Au, a cut off of 0.25 g/t Au throughout 42,396,600 tonnes.

The Newton Project deposit remains open in multiple directions with potential for increased size, grade, and additional mineralized areas. The current inferred mineral resources occupy only approximately 7% of the area of an underling broad induced polarization ("IP") anomaly. Immediate areas for follow up include south and southwest of the current inferred mineral resource, where historic drilling has intercepted mineralized volcanics, which are not part of the updated Newton Project resource calculation, as well as down dip to the southwest, where the mineralization remains open. Much of the large Newton Project sulphide-bearing alteration zone, as defined by Amarc Resources Ltd.'s 2010 IP survey, has not been thoroughly explored. The Newton Project gold deposit lies within a northwest trending total field magnetic low that extends approximately 500 m to the northwest beyond the deposit as defined by the densest drilling, to an area where the few exploration holes returned geologically important intersections of greater than 100 ppb (0.1 g/t) Au, such as hole 92-03 that returned 54 m grading 0.50 g/t Au including 30 m grading 0.70 g/t Au, and hole 10023 that returned 39 m at 1.21 Au, indicating potential to host additional inferred mineral resources. In addition, to the north, mineralization in hole 12076 has not been fully explored and in the south, the mineralized intervals in hole 12086 are indicative of resource potential in this vicinity.

Project Highlights

- The Newton Project is a large, bulk tonnage, low - to intermediate-sulphidation, epithermal gold deposit with nearly 35,000 m of drilling exploring and developing the historical resource, primarily between 2009-2012.

- Updated pit-constrained inferred mineral resource contains 861,400 oz of Au, and 4,678,000 oz of Ag with an average grade of 0.63 g/t Au, a cut off of 0.25 g/t Au throughout 42,396,600 tonnes.

- The Newton Project encompasses more than 24,000 ha.

- Mineralization occurs within an 800 x 400 m area defined by drilling to depths of approximately 500 m with majority of the drill holes not exceeding 300 m depth.

- Underlying the deposit, a large IP anomaly measures 4 km x 2 km and covers an area greater than 7 km2 - yet the existing inferred mineral resource occupies slightly over 0.5 km2 or just 7% of the anomaly.

- Gold and associated base metal mineralization precipitated in extensive zones of strong quartz-sericite alteration as well as in mafic volcanic and clastic sedimentary rocks and along fault and fracture zones.

- The alteration assemblages and metal associations at the Newton Project are similar to the Blackwater Gold Project deposit of Artemis Gold Inc. ("Artemis") The Blackwater Gold Project, which is in construction phase, is located approximately 185 km northeast of the Newton Project, where it is one of Canada's largest open-pitable gold deposits and one of the world's largest environmental assessment approved gold development projects. The Blackwater Gold Project has a measured + indicated resource estimated at 11.7 million ounces Au and 122 million ounces of Ag (see Artemis' "Blackwater Gold Project British Columbia NI 43-101 Technical Report on Updated Pre-Feasibility Study", authored by Robin Kalanchey, et al., September 10, 2021; www.artemisgoldinc.com).

A copy of Carlyle's NI 43-101 technical report entitled "Technical Report on the Updated Mineral Resources Estimate for the Newton Project, British Columbia, Canada" dated June 13, 2022 authored by Michael F. O'Brien, P.Geo., and Douglas Turnbull, P.Geo., which contains the updated Newton Project resource calculation, is available under Carlyle's profile on SEDAR.

Quality Assurance/Quality Control (QA/QC)

Carlyle has applied a rigorous quality assurance/quality control program at the Newton Project using best industry practice. All core was logged by a geoscientist. The Newton drill core was drilled at NQ diameter. The drill core was split in half using a core saw and each sample half was placed in a marked sample bag with corresponding sample tag then sealed. The remaining half core is retained in core boxes that are stored in a secure facility. The chain of custody of samples was recorded and maintained for all samples from the drill to the laboratory.

All diamond drilling sample batches included 5% QA/QC samples consisting of certified blanks, standards, and field duplicates. Multiple certified ore assay laboratory standards and one blank standard were used in the process. Samples were submitted to Bureau Veritas British Columbia, an independent ISO 9001: 2008 certified lab, for gold, silver and base metal analysis using Inductivity Coupled Plasma (ICP), and Fire Assay (FA) methods.

Samples were prepared by crushing the entire sample to 75% passing 2mm, riffle splitting 250g and pulverizing the split to better than 85% passing 75 microns. Gold was analyzed using a 30-gram fire assay and ICP-AES. The performance on the blind standards, blanks and duplicates achieved high levels of accuracy and reproducibility and has been verified by Jeremy Hanson, a qualified person as defined by NI 43-101.

Qualified Person

Jeremy Hanson, P.Geo. and a Qualified Person for purposes of NI 43-101, has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Information regarding Artemis' Blackwater Gold Project contained in this news release has not been verified by Mr. Hanson and such information is not necessarily indicative of the mineralization on Carlyle's Newton Project.

About Carlyle

Carlyle is a mineral exploration company focused on the acquisition, exploration, and development of mineral resource properties. Carlyle owns 100% of the Newton Project in the Clinton Mining Division of B.C. and is listed on the CSE under the symbol "CCC", on the OTCQB Market under the ticker CCCFF, and on the Frankfurt Exchange under the ticker BJ4.

ON BEHALF OF THE BOARD OF DIRECTORS OF

CARLYLE COMMODITIES CORP.

"Morgan Good"

Morgan Good

President and Chief Executive Officer

For more information regarding this news release, please contact:

Morgan Good, CEO and Director

T: 604-715-4751

E: [email protected]

W: www.carlylecommodities.com

Cautionary Note Regarding Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance, including without limitation, statements regarding, the Company's plan to finalize a more finely tuned phase 2 drilling strategy to test certain potential higher-grade zones, the potential expansion of the current inferred mineral resource in the Newton Project, the Company's intention to complete a more robust phase 2 drill program and focus on potentially higher-grade near surface zones, that the Newton Project may contain additional highly prospective underexplored felsic domains and the Company's intention to test for the same in subsequent drill programs, the potential overall size of the Newton Project and the fact that there may be a higher-grade zone of interest to target early in a phase 2 drill program this spring, that near surface higher-grade intercepts confirmed in drill hole N23-091, along with historical, underexplored near surface higher-grade intercepts, will be a key focus in phase 2 drilling are forward-looking statements and contain forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should" or "would" or occur. Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this press release, including, without limitation, that management's hypothesis for mineralization in the Newton Project proves correct, that the Company will develop and pursue a phase 2 drill program as anticipated and within the expected time frame, that there will be no adverse changes in legislation, policies, or rules that impact the Company's ability to continue to pursue its business objectives as excepted, that the Company will not come across any land access, environmental or social issues that impact its business plans, that the Company will have access to the resources required to pursue a phase 2 drill program and that the Company will be successful in expanding the current inferred mineral resource estimate in the Newton Project. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important factors that may cause actual results to vary, include, without limitation: that a phase 2 drill program will not improve the Company's current inferred mineral resource estimate as anticipated or at all; that managements hypotheses for mineralization on the Newton Project is incorrect; general business, economic and social uncertainties; the Company's failure to secure the resources required to complete the phase 2 drill program, as anticipated, or at all; the loss of key personnel; unanticipated costs; adverse litigation, legislative, environmental, and other judicial, regulatory, political, and competitive developments; and other risks outside of the Company's control. Further, the ongoing COVID-19 pandemic, labour shortages, high energy costs, inflationary pressures, rising interest rates, the global financial climate and the conflict in Ukraine and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company's operating performance, business plans, financial position and future prospects.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. These forward-looking statements are made as of the date of this news release and, unless required by applicable law, the Company assumes no obligation to update these forward-looking statements.

Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/162841