Permutable AI, a leading provider of cutting-edge business intelligence solutions, has released a comprehensive analysis of US institutions' quarterly filings spanning the dynamic period of 2022-2023. The data offers a detailed snapshot of strategic moves made by institutional investors, encompassing a staggering 9.7 million transactions across 6574 institutional investors and 40 industry groups.

In a financial landscape marked by unprecedented shifts and global uncertainties, Permutable AI's analysis provides valuable insights into the stock holdings of major institutions. This extensive study reveals noteworthy trends, shedding light on the nuanced strategies employed by investors over the last two years.

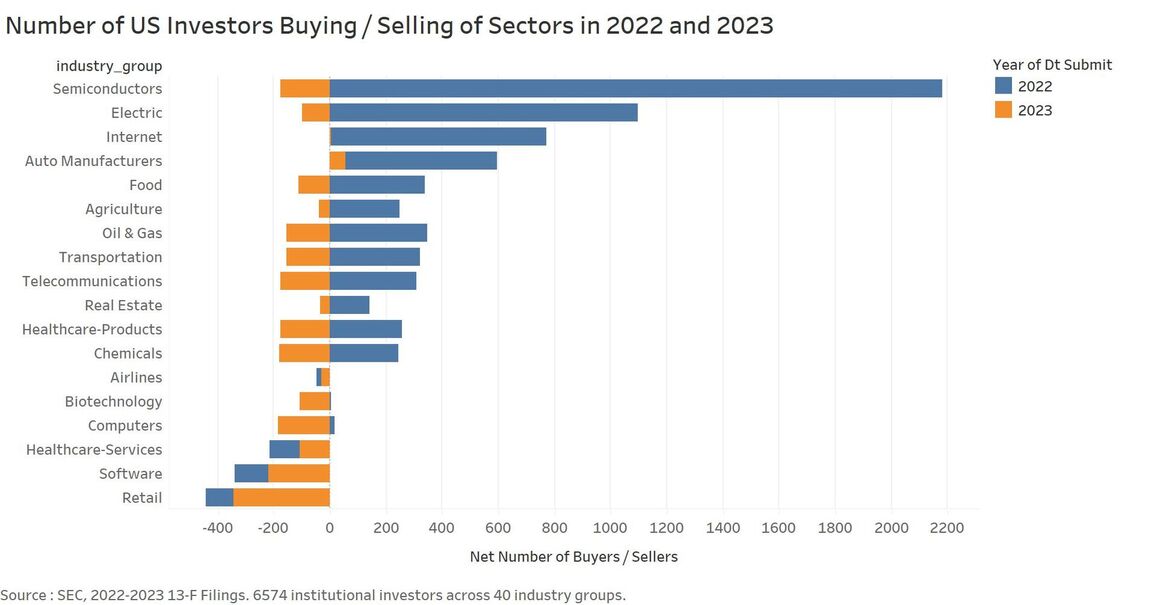

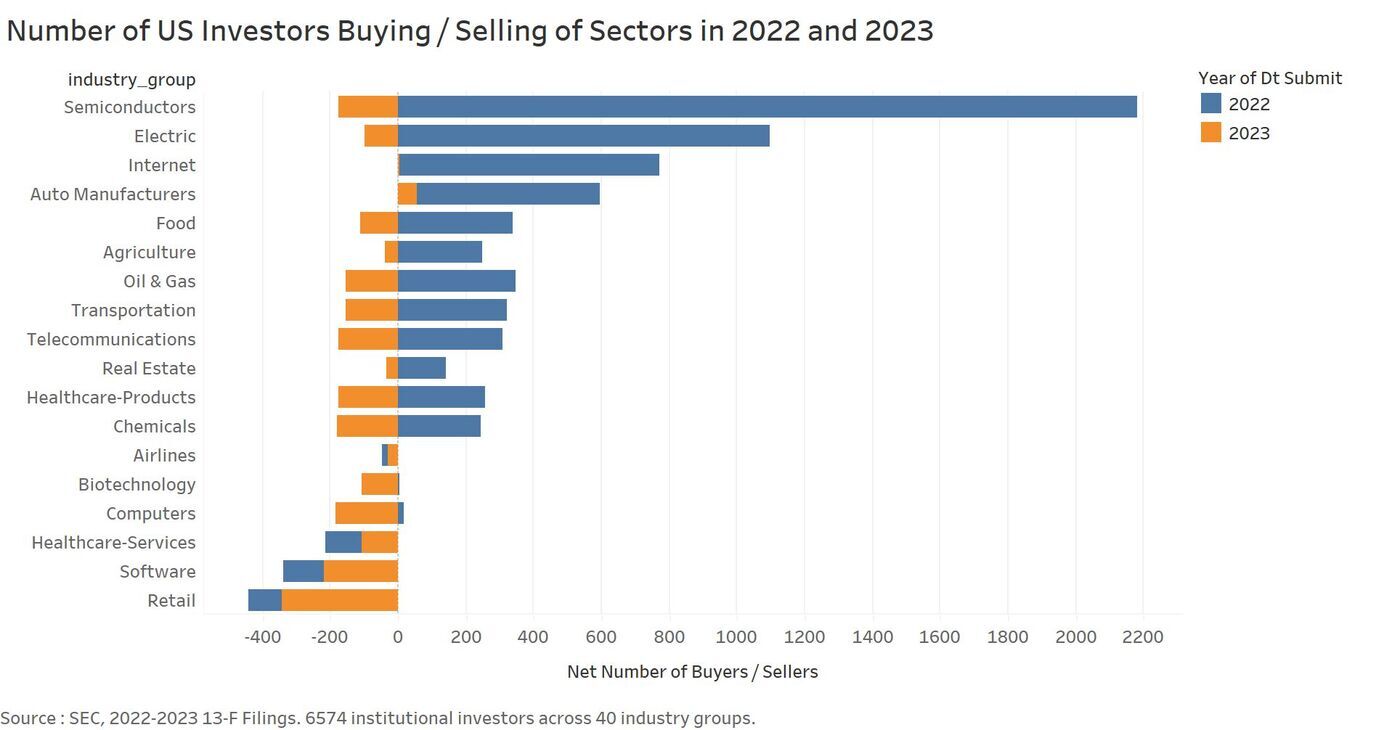

One of the standout observations is the general sell-off across sectors observed in the current year. Investors are notably reallocating their portfolios towards cash positions, reflecting a cautious stance in response to evolving market conditions. This strategic move underscores the adaptability of institutional investors in navigating a complex financial environment.

A particularly intriguing trend highlighted in the analysis is the surge in stock acquisitions within the semiconductor and electric sectors throughout 2022. The data suggests a collective bet on ventures related to artificial intelligence and energy transition, supported by a robust industry-wide confidence. The strategic emphasis on these sectors signifies a forward-looking approach by institutional investors, aligning their portfolios with the technological advancements and sustainability initiatives shaping the future.

Key Findings:

- 9.7 Million Transactions: The analysis covers an extensive 9.7 million transactions, providing a granular view of institutional movements.

- 6574 Institutional Investors: A diverse range of institutional investors were part of the study, reflecting the broad spectrum of market participants.

- 40 Industry Groups: The analysis spans 40 industry groups, offering a sector-wise breakdown of institutional strategies.

- Sectoral Sell-Off: The current year has witnessed a general sell-off across sectors, indicative of a cautious approach adopted by institutional investors.

- Semiconductor and Electric Sectors: A notable trend is the surge in stock acquisitions within the semiconductor and electric sectors, showcasing confidence in AI and energy transition-related ventures.

Wilson Chan, Permutable AI CEO commented, "Permutable AI's commitment to empowering market participants and industry stakeholders is highlighted through in this comprehensive analysis. By deciphering intricate details of institutional transactions using our cutting edge AI and machine learning capabilities, our report serves as a valuable resource for navigating the complexities of the financial landscape."

As Permutable AI continues to pioneer in delivering real-time AI-driven analytics, this analysis stands as a testament to the company's commitment to providing valuable, data-driven insights for informed decision-making in the ever-evolving financial landscape. For more information please contact [email protected].

Disclaimer: This press release is for informational purposes only. The information does not constitute investment advice or an offer to invest. Neither KISS PR or its partners are responsible for the listed data, information and reports. The source is solely responsible for any claims made. Please conduct your own research or consult a financial advisor before making any investment decisions.