DeLuca & Associates Bankruptcy Law announced that it is offering free consultations to help Southern Nevada residents review their debt-relief choices and determine whether Chapter 7 or Chapter 13 bankruptcy is the better route based on income, assets, and goals. The no‑cost meetings give consumers time with an attorney to assess eligibility, understand timelines, and learn how filing can pause collections through the automatic stay.

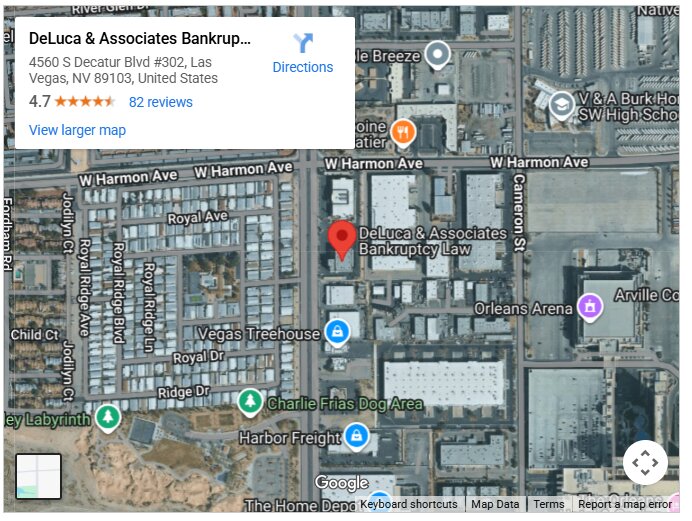

The firm’s website prominently notes that consultations are free, and its Las Vegas office address and phone number are listed for easy scheduling.

“People often arrive overwhelmed by bills, wage garnishments, or the threat of repossession,” said the managing partner of DeLuca & Associates. “Our role in the consultation is to translate the rules of Chapter 7 and Chapter 13 into plain English and show what each path would look like for their household.”

For those searching for a top-notch bankruptcy attorney Las Vegas has can use the free consultation to compare the core differences between liquidation under Chapter 7 and reorganization under Chapter 13. It includes how debts are treated, who typically qualifies, and what it takes to protect a home or vehicle. The firm explains on its site that attorneys review each person’s financial picture and discuss which chapter they are eligible to file, along with a clear explanation of how the chapters differ.

DeLuca & Associates focuses its practice on consumer bankruptcy and has helped tens of thousands of Nevadans file over the last two decades. The firm’s service pages underscore that clients meet with lawyers who handle the work from start to finish.

A central topic in each consultation is how bankruptcy may immediately halt creditor actions. The firm’s homepage explains that bankruptcy can stop wage garnishment and creditor harassment and may protect key assets such as a home, car, and wages, while its Chapter 7 explainer discusses the automatic stay that requires most creditors to stop collection activity. These practical protections often drive the choice of chapter and the timing of a filing.

The firm encourages anyone receiving collection calls or facing lawsuits, foreclosure, or repossession to schedule a free meeting to understand how a filing would work in practice and what life looks like after discharge—topics the site addresses in its FAQs and educational articles.

According to DeLuca & Associates, Chapter 7 is often used to wipe out unsecured debts such as credit cards and medical bills; the firm explains that the automatic stay takes effect upon filing and that state and federal exemptions may allow clients to keep essential property. Chapter 13 is presented as a structured repayment plan that can help catch up on secured debts over three to five years while keeping assets, with eligibility shaped by income and debt limits.

Learn more about DeLuca & Associates Bankruptcy Law by visiting the website at https://www.deluca-associates.com/

About DeLuca & Associates Bankruptcy Law

DeLuca & Associates Bankruptcy Law is a Las Vegas–based consumer law firm concentrating on Chapter 7 and Chapter 13 matters for individuals and families across Nevada. Since 2001, the firm has represented thousands of clients seeking a fresh financial start.

###

Media Contact

DeLuca & Associates Bankruptcy Law

4560 S Decatur Blvd #302, Las Vegas, NV 89103

(702) 252-4673

https://www.deluca-associates.com/

newsroom: news.38digitalmarket.com