OnFolio, the brainchild of Dominic Wells, took off in 2019 when it was founded to acquire online businesses to increase their value and sustainability, ensuring that the company continues to grow and make money for their shareholders.

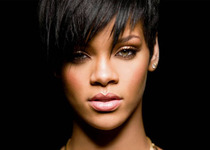

Much like any company, OnFolio started off small, but with Wells at the helm, the company grew exponentially and is set to continue dominating the market. With close to a decade of experience under his belt, Wells has been growing online businesses successfully enough to be featured as a leading voice in the ecommerce space, including a regular Newsweek column.

The company started working with individual investors but decided to pivot into a holding company, raising close to 4 million dollars over the past 12 months. With Dom Wells at the helm, the team has grown to 25 professionals who are focused on growing the company so that OnFolio is able to go public in the US in early 2022.

The company buys profitable online businesses in order to improve them and increase their revenue. Aside from having operational experience in marketplaces, content-driven sites, and profitable online businesses, OnFolio is also highly experienced in the acquisition industry, and understands the ins and outs of acquiring businesses. Aside from that, they have a sharp eye for which businesses are good for acquiring, which businesses are underperforming despite having the potential to grow, and which businesses are unsustainable.

OnFolio’s average acquisition ROI is above 25% and they don’t acquire companies for more than four times EBITDA. Since their long term cost of capital is expected to be around 10%, this gives them a lot of margin for rinsing and repeating the model.

Raise capital or debt, buy businesses, grow businesses, repeat.

The requirements for a business to be considered for acquisition by OnFolio is heavily reliant on how well the business may complement the existing portfolio. You can expect to see a huge diversification in their portfolio, because Wells is never of the belief that you should put all of your eggs in one basket. On the contrary, he thinks that diversification is the rule to success, especially in the world of investment where reducing investors’ risk and maximising their upside is key.

Unleveraged marketing assets such as a large and engaged audience that aren’t being fully utilized will also catch OnFolio’s eye as they are very focused on building on what is already there and expanding on it so that their own company grows, and that their shareholders reap the benefits alongside them. OnFolio’s success is based on Wells and his team’s keen eye for potential in underpriced assets.

Currently, accredited investors can join as an Onfolio preferred shareholder with a 12% annual dividend which is paid quarterly. For others in the same niche and interests as OnFolio, there are also countless valuable resources that can be gleaned from their private mailing list. For the entrepreneur who has a profitable business, there’s also the potential for your company to join theirs, as long as you have something that sets you apart from the rest.

This is not an offer to sell or a solicitation of an offer to buy securities or to subscribe to services herein. This information is not intended, nor should it be distributed, for advertising purposes, nor is it intended for publication or broadcast to the general public.

Original Source of the original story >> Dominic Wells taking OnFolio public