In 2022 – while the whole world was embroiled in tense geopolitical and economic uncertainties – the US dollar bathed in the rays of glory. The USD demonstrated great results in relation to most currencies, and this situation lasted most of last year. At the same time, the Australian dollar was overshadowed by his Big Brother barely keeping pace with him. Well, it's the beginning of 2023, and now the U.S. dollar squanders the lead, while the Australian dollar continues to move steadily upwards. Let's see why the Aussie is such an attractive performance for investors and what the future holds for the AUD/USD currency pair.

The last year could have been the first one belonging to the post-Covid era. Of course, the pandemic wasn’t going to just fully disappear, but many of us expected economic growth, mass travel resumption, reopening of music venues holding great festivals and lots of other nice things. Unfortunately, instead of these expectations, our worst fears became reality – we faced the consequences of the military conflict between Russia and Ukraine, record inflation level and depression of economic activity around the world.

All these factors were a disruptive influence on everything but the US dollar. Every piece of bad news fueled the USD quote value, making it bigger and bigger like that Snake game from Nokia phones.

There are several simple reasons why the USD became a top dog. The first is the Federal Reserve policy. The Fed was raising the interest rate every now and then much more aggressively than other central banks. As a result, the USD seemed more and more attractive for investors craving to get some profit. The investors (being dead set on profit) know that any news event, and rate hikes belonging to this group, will most likely hurt currency and commodity markets. To know all about major economic events – they use the economic calendar.

The other reason is the general economic situation around the globe. People have fewer options for investments when all markets are crashing, inflation is escalating and local currencies are having a pretty tough time. That’s why people have always seen the USD as a safe-haven asset, and whatever the circumstances, have been buying greenbacks to wait out the storm.

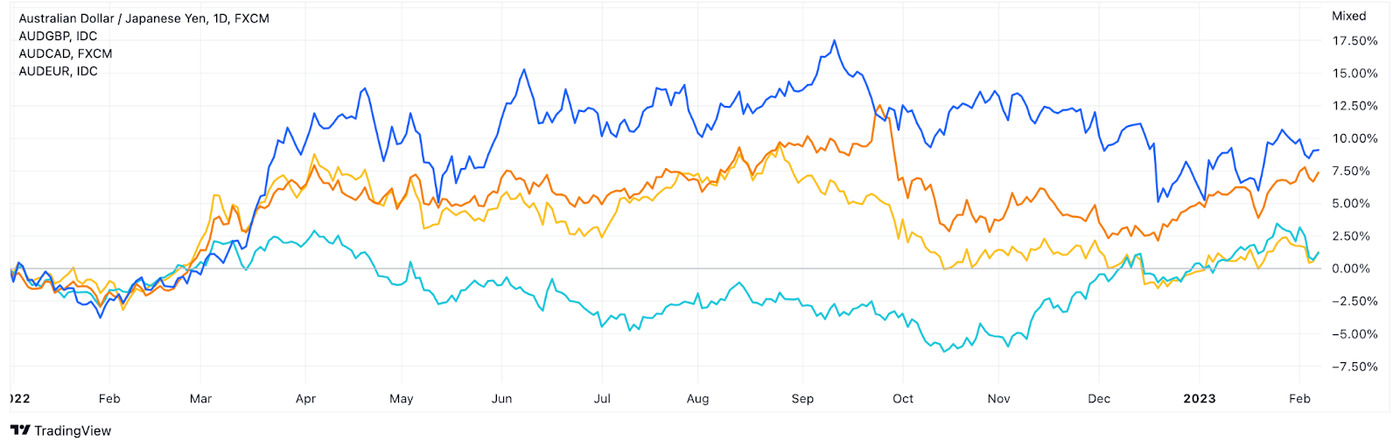

But what about the Australian dollar? Firstly, let’s look at the chart showing the performance of the Australian dollar in relation to the Japanese yen, the British pound sterling, the Canadian dollar and the euro from the beginning of 2022 until now. The AUD is a clear leader.

The Reserve Bank of Australia maintained rigorous activity in 2022 – its hawkish policy led to the increase of the interest rate from 0.1% to 3.1%. Also, we can clearly see on the chart above the moment when the experts decided that the American Fed would stop hiking the rate – at the same time the RBA went the extra mile. So, the difference between the policies utilized by central banks was the reason for the change of the market trend.

In addition, Australia enjoyed another growth factor. China – a key direction for Australian export – eased up Covid restrictions, which is positive news for the AUD and not so positive for the USD. The AUD is supported by the improvement of the economic situation and the growth in price for some Australian commodity exports like iron ore and copper. The USD seems less interesting for investors because they’ve got China and other emerging markets as an increasingly appealing alternative.

And one should not forget about the warm winter in Europe. Yeah, we know this is supposed to be about the US and Australian currencies, and you’re probably thinking “What does it have to do with Europe?”. The anticipation of the cold European winter was supportive for the USD – now this factor is playing a dirty trick on it.

What’s next? The important thing for the AUD/USD pair in the near future is probably going to be the difference between the policies of the Reserve Bank of Australia and those of the US Federal Reserve. The experts believe that the RBA is likely to hike the rate three more times. The estimated amount of hikes forecasted for the Fed is just one or two.

It means that we are unlikely to see significant changes in the balance of this pair, but the AUD might show better results and grow against the USD by the end of 2023. But don’t forget – life the market is full of curveballs. So before making any trades, you should always do your own relevant research.

Original Source of the original story >> AUD/USD: The Tale Of Two Currencies